Overview of Nikkei 225

The Nikkei 225, also known as the Nikkei Stock Average, is a stock market index that measures the performance of 225 of the largest and most actively traded companies listed on the Tokyo Stock Exchange (TSE). It is one of the most widely followed stock market indices in the world and is considered a benchmark for the Japanese economy.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride lately, with investors anxiously watching its every move. The index has been closely correlated with global markets, and the recent volatility in the U.S. stock market has had a ripple effect on the Nikkei.

However, some analysts believe that the Nikkei is undervalued and could be poised for a rebound. They point to the strong fundamentals of the Japanese economy and the fact that the Nikkei is trading at a discount to other major stock indices.

Only time will tell if the Nikkei can shake off its recent lethargy and regain its former glory, but for now, investors are left wondering if they should stay awake like in the movie Sleepless in Seattle or cash out and go to sleep.

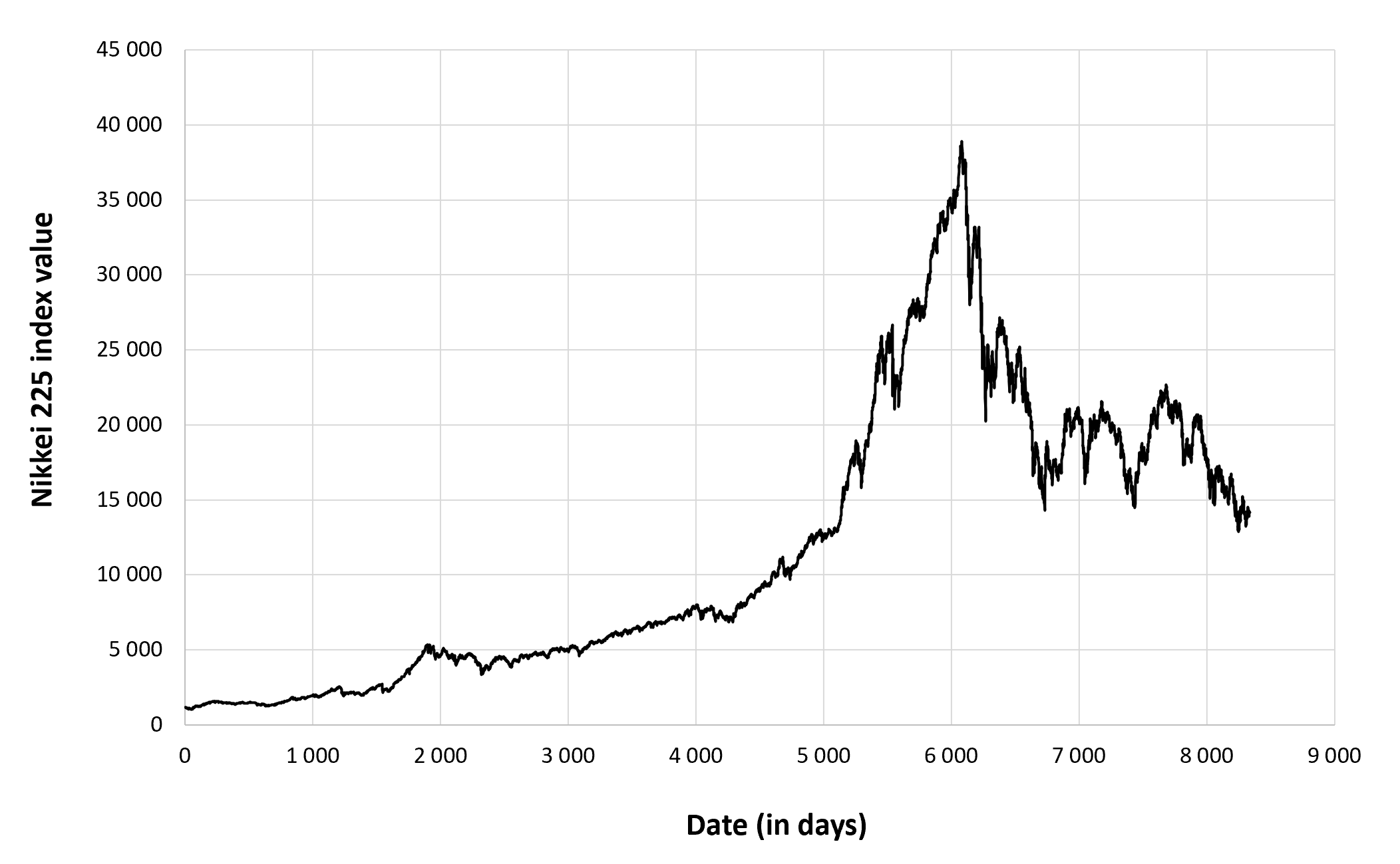

The Nikkei 225 was created in 1950 and has since become a symbol of Japan’s economic growth and development. The index has experienced significant growth over the years, with some notable peaks and troughs along the way. In 1989, the Nikkei 225 reached its all-time high of 38,915.87 points, but it crashed shortly after, entering a period of decline known as the “Lost Decade.” The index has since recovered and has been trending upwards in recent years.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride in recent months. After hitting a record high in October 2021, the index has since fallen by more than 20%. However, it has recently started to recover, and some analysts believe that it could be poised for further gains.

Click here to learn more about the Nikkei 225 and its recent performance.

Factors Influencing Nikkei 225 Movements

The Nikkei 225 is influenced by a variety of factors, including economic conditions, corporate earnings, interest rates, and global events. Economic growth and corporate profitability tend to have a positive impact on the index, while economic downturns and declining earnings can lead to declines. Interest rates also play a role, as low interest rates can encourage investment in stocks, while high interest rates can make stocks less attractive.

Composition and Methodology of Nikkei 225

The Nikkei 225 is a price-weighted index that tracks the performance of the top 225 publicly traded companies in Japan. The index is calculated by taking the sum of the share prices of the constituent companies and dividing by the Nikkei 225 divisor. The divisor is adjusted periodically to ensure that the index remains representative of the overall Japanese stock market.

Companies Included in the Nikkei 225 Index

The companies included in the Nikkei 225 index are selected based on the following criteria:

- The company must be listed on the Tokyo Stock Exchange’s First Section.

- The company must have a market capitalization of at least 500 billion yen.

- The company must have a free float of at least 20%.

Weighting System Used in the Index Calculation

The Nikkei 225 index is a price-weighted index, which means that the weight of each company in the index is determined by its share price. The higher the share price of a company, the greater its weight in the index. This means that the performance of the Nikkei 225 index is heavily influenced by the performance of a few large companies.

Impact of Nikkei 225 on Japanese Economy

The Nikkei 225 index plays a crucial role in reflecting the overall health of the Japanese economy. It serves as a barometer, providing insights into the performance of the country’s stock market and the broader economic landscape.

Fluctuations in the Nikkei 225 index can significantly impact investor sentiment. Positive index movements often boost confidence and encourage investment, while negative movements can lead to uncertainty and risk aversion. This, in turn, affects the flow of capital into and out of the Japanese economy.

Economic Decision-Making

The Nikkei 225 is widely used by economists, policymakers, and business leaders to make informed decisions. The index provides valuable information about the direction of the economy, helping them assess risks, plan investments, and formulate policies that support economic growth.

The Nikkei 225, Japan’s benchmark stock index, has been on a roller coaster ride in recent months. Investors are eagerly awaiting the release of a knight of the seven kingdoms tv show release date as it could provide some much-needed stability to the market.

The Nikkei 225 has been closely following the global economic recovery, and a strong showing by the TV show could be a sign that the global economy is on the mend.

Nikkei 225’s recent surge has analysts predicting a bullish trend, but it’s worth noting that geopolitical uncertainties, such as the upcoming austria france prediction , could impact market sentiment. Nonetheless, the Nikkei 225’s fundamentals remain strong, suggesting continued growth potential.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride in recent months. The index has been hit by a number of factors, including the ongoing trade war between the United States and China, as well as political uncertainty in Austria Francia.

Despite these challenges, the Nikkei 225 has managed to stay afloat, and analysts are optimistic about its future prospects.